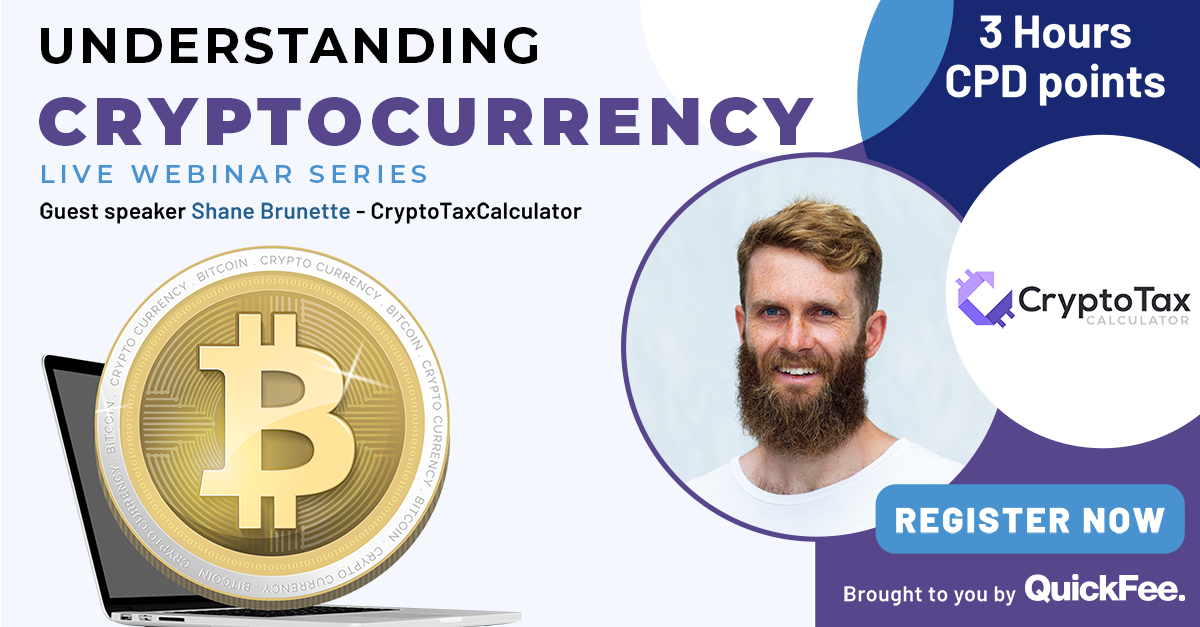

In this series, we discuss some of the use cases behind cryptocurrencies and the consequences from a tax and legal perspective. Learn about emerging concepts such as peer-to-peer lending on the blockchain, and NBA’s $700 million NFT marketing strategy. We discuss the common missteps from a tax perspective, and how accountants can handle some of this complexity with the right crypto tax knowledge.

Access the Crypto Series (3h FREE CPD Points):

About CryptoTaxCalculator

CryptoTaxCalculator are building the platform to make understanding your tax obligations simple and straightforward. Their tools help identify, track and organise all your crypto activity across hundreds of exchanges and blockchains with ease and accuracy. Their reporting saves you time and makes your transaction history transparent and easy to understand. They are helping investors, traders and accountants by providing clear and secure records of your crypto activity so you can relax at tax time.

Click here to learn more about CryptoTaxCalculator

Discover their crypto tax guide that is constantly updated with the up-to-date information from the ATO: Click here to access the crypto tax guide