QuickFee

Payment Portal with Fee Funding

Get more payment options all under one roof. Get paid faster.

QuickFee Secure Online Payments (QSOP)

QuickFee Secure Online Payments portal

Using QuickFee llow your clients to pay how they want, when they want.

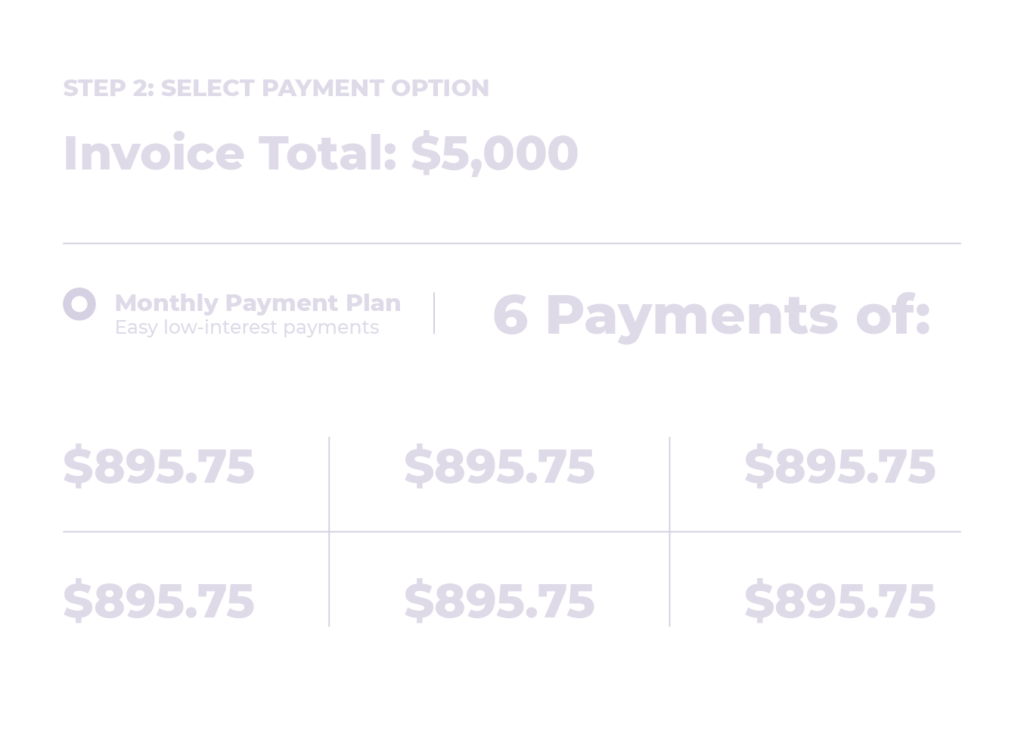

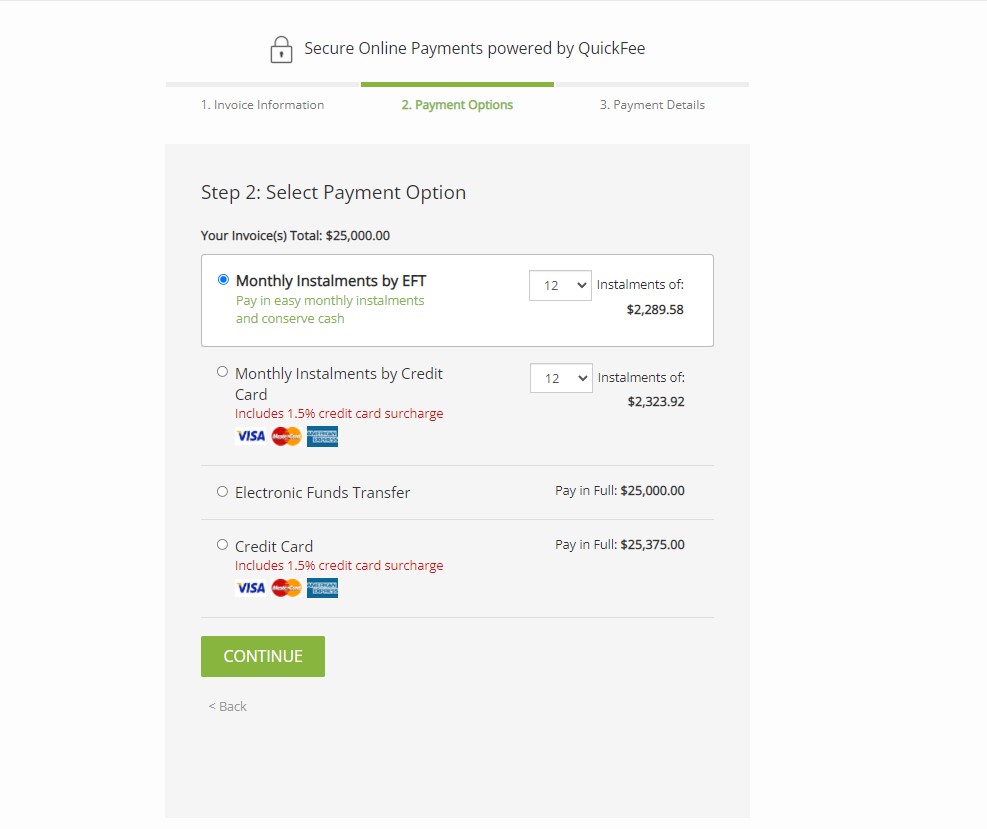

- Let your clients pay in full or via monthly instalments.

- Get paid in full within your terms.

- Reduce collection admnistration.

- Provide clients 24/7 access to make payments, using your QuickFee self service, secure online portal.

- Allow clients to easily access financing, with a choice of monthly payments between 3 and 12 months.

- Accept Visa, Mastercard, Amex and EFT payments at no extra costs to your firm.

Special Offer for Bizink's Clients

- Get 50% OFF the setup the fees of your new payment gateway with QuickFee. Save a minimum of $200 + GST.

- Bizink will have your beautiful QuickFee payment page ready for FREE. Bizink will develop and add QuickFee pages to your website as part of their package. Valid for new or existing clients of Bizink and QuickFee Fee Funding.

- Get your new website today and pay using a QuickFee monthly payment plan. Split the cost of your website into easy, monthly instalments with Bizink and QuickFee Fee Funding.

Use Promo Code: Bizink

Fee Funding Option

Delight customers with payment financing flexibility.

QuickFee Fee Funding is an easy way to take control of your operational costs, while helping customers manage their own expenses. Just send a payment plan quote anytime to make your services more affordable.

Best of all? Your business will always get paid in full and upfront.

Using QuickFee enables you to streamline your payment processes from preparing contracts right through to processing payment instalments.

Simple setup.

You’ll get your payment portal ready within 1 or 2 business days.

Security first.

Protect yourself and your customers with a reliable, PCI compliant payment gateway.

Get paid anytime.

Customers can pay 24/7 through one online payment link.

Touchless transactions.

Just add your payment portal link to your emails, website or invoices.

Easy integrations.

It only takes a few clicks to integrate with your practice management system.

Trusted for financing solutions since 2009:

Service providers worldwide

Average reduction in overdue payments

Funded for customers

A robust payment platform for every need.

Thousands of small businesses and professional service providers use QuickFee to offer convenience, cut costs, and simplify their workflow.

The QuickFee payment portal can be customised to meet the needs of your firm and your clients.

How does it work?

After signing up, you’ll get a custom payment portal to share with your customers.

Our payment solution experts will walk you through best practices and get you started.

Accept payments via your website, invoices, emails, etc.

Customer-centered convenience that works with your process.

Amazing things happen when your payment process puts customers first. By providing easy access to financing to your clients, you’ll get paid faster, reduce collections and improve your cash flow over time. (You’ll also spend less time on manual data entry.)

Key Benefits:

Smooth over your cash flow. Get paid upfront every time when customers can choose low-interest financing.

Spend less on collections.

It shouldn’t take months to get paid for your work. Cut down on collections with payment plans.

Close faster with prospects. With access to funding, customers are more likely to buy all the services they need.

Secure, reliable funding.

All payment plans go through a secure payment portal where you can review and approve.

A strong support team for payment plans:

+ Dedicated QuickFee specialist to help you generate payment plan quotes, reach out to late payers, or answer questions

+ Complete starter kit with marketing materials and resources

+ No additional time, costs, or setup to start offering payment plans